BRICS Nations Plan to Create Payment Network Backed by Digital Currencies in Quest of De-Dollarisation: Report

The BRICS group is planning to develop a digital payment network, backed by digital currencies. The aim is to bring a wave of de-dollarisation into effect.

Brazil, Russia, India, China and South Africa – the five nations that constitute the BRICS group – are trying to reduce their dependency on the US dollar. To bring this wave of de-dollarisation into effect, the BRICS group is planning to develop a digital payment network, backed by digital currencies. This information has been disclosed in a recent report published by Russian news agency TASS. This independent and potentially decentralised payment system will be supported on blockchain networks.

“The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics," the TASS report quoted Yury Ushakov as saying in a recent interview. Ushakov has been an advisor to the Russian president Vladimir Putin on foreign policy issues since 2012.

Countries of the BRICS group are exploring ways to increase their participation in shaping up the financial and monetary systems on an international level. This payment network, once created, will likely set precedence for other countries in-terms of including digital currencies into their existing fintech systems.

The plans to bring together a new digital payment network has been initiated after certain discussions that sparked during the 2023 Johannesburg Declaration. At the time, leaders of the BRICS group decided to lay focus on ways to process settlements in currencies that are not the US dollar.

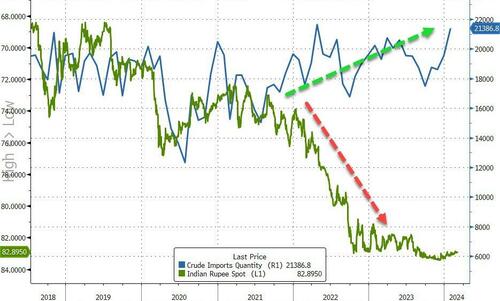

The US dollar has presided over the global economy for decades. However, in the post-COVID-19 era, the US dollar has seen volatile times owing to back-to-back interest rate hikes which were announced to stabilise the US economy against the climate of inflation.

With US having increased its interest rate, several central banks around the world were also compelled to raise their respective interest rates – which led to financial losses for weaker and developing economies.

This served as a major nudge for the BRICS group to start looking for alternative payment options which do not rely on one single fiat currency like the US dollar.

As per the TASS report, Ushakov has said, “Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar.”

While the BRICS nations ramp up their work around the creation of this payment infrastructure, the Financial Stability Board (FSB) has said that it will continue to work with the G20 group of nations on formulating and deploying regulations that would govern the digital currency ecosystem uniformly on a global level.

What's Your Reaction?

.jpeg?#)

.jpg?#)