De-Dollarization In Delhi - India Urges Gulf Exporters To Accept Rupees For Crude

De-Dollarization In Delhi - India Urges Gulf Exporters To Accept Rupees For Crude Four months after India's government rejected demands from Russian oil companies to pay for Russia's crude exports in Chinese yuan, it appears India is now hoping for a similar arrangement with Gulf crude exporters. Bloomberg reports that the Reserve Bank of India (RBI) has asked the country’s major state-owned refiners to press Persian Gulf suppliers to accept at least 10% of oil payments in rupees in the next financial year, three executives at the processors said. The RBI is concerned that the nation's soaring demand for energy will weaken the rupee, something that has been a general trend over the last two years (India refiners must sell Rupees to buy USDollars to settle the payments for their increasing heavy demand for crude). The executives that Bloomberg sourced also noted that India wants to leverage the growth in consumption to its own advantage, by promoting the Indian currency in international trade and cutting dependence on dollars. The three refiners - Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. - have already approached oil exporters on the matter, but the suppliers are pushing back due to currency risk and conversion charges, the executives said. The vast majority of global oil transactions are in dollars, although China has had some success in using the yuan more to pay for imports. Indian Oil partly paid Abu Dhabi National Oil Co for a shipment of 1 million barrels of crude in rupees last August. However, there haven’t been any transactions in the currency since then. The country’s refiners have also used other currencies - include UAE dirhams - to pay for Russian crude. This decision by India comes just days after a report by Russian news agency TASS said that the five-nation BRICS group comprising Brazil, Russia, India, China and South Africa will work on creating a payment system based on blockchain and digital technologies. “We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics,” Kremlin aide Yury Ushakov said in an interview with TASS. As CoinDesk reports, the effort is part of a specific task for this year to increase the role of BRICS in the international monetary system. For some time now, the BRICS grouping has been making efforts to reduce its reliance on U.S. dollars in settlement, also known as de-dollarization. “Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar," Ushakov said. India is the world’s third-largest crude importer and is forecast to be the leading driver of global consumption growth this decade. Tyler Durden Tue, 03/05/2024 - 22:00

Four months after India's government rejected demands from Russian oil companies to pay for Russia's crude exports in Chinese yuan, it appears India is now hoping for a similar arrangement with Gulf crude exporters.

Bloomberg reports that the Reserve Bank of India (RBI) has asked the country’s major state-owned refiners to press Persian Gulf suppliers to accept at least 10% of oil payments in rupees in the next financial year, three executives at the processors said.

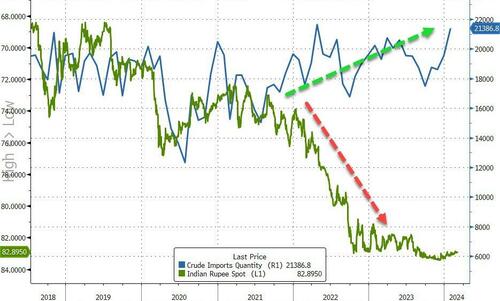

The RBI is concerned that the nation's soaring demand for energy will weaken the rupee, something that has been a general trend over the last two years (India refiners must sell Rupees to buy USDollars to settle the payments for their increasing heavy demand for crude).

The executives that Bloomberg sourced also noted that India wants to leverage the growth in consumption to its own advantage, by promoting the Indian currency in international trade and cutting dependence on dollars.

The three refiners - Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. - have already approached oil exporters on the matter, but the suppliers are pushing back due to currency risk and conversion charges, the executives said.

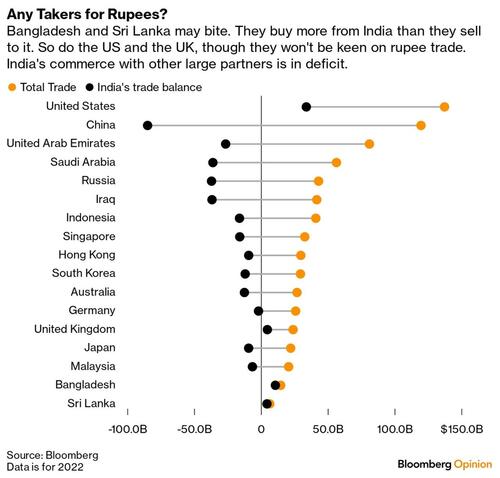

The vast majority of global oil transactions are in dollars, although China has had some success in using the yuan more to pay for imports.

Indian Oil partly paid Abu Dhabi National Oil Co for a shipment of 1 million barrels of crude in rupees last August.

However, there haven’t been any transactions in the currency since then.

The country’s refiners have also used other currencies - include UAE dirhams - to pay for Russian crude.

This decision by India comes just days after a report by Russian news agency TASS said that the five-nation BRICS group comprising Brazil, Russia, India, China and South Africa will work on creating a payment system based on blockchain and digital technologies.

“We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics,” Kremlin aide Yury Ushakov said in an interview with TASS.

As CoinDesk reports, the effort is part of a specific task for this year to increase the role of BRICS in the international monetary system.

For some time now, the BRICS grouping has been making efforts to reduce its reliance on U.S. dollars in settlement, also known as de-dollarization.

“Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar," Ushakov said.

India is the world’s third-largest crude importer and is forecast to be the leading driver of global consumption growth this decade.

What's Your Reaction?

.jpeg?#)

.jpg?#)